Welcome to StableUnit 101

One-Liner

StableUnit is a CDP protocol with two complementary products:

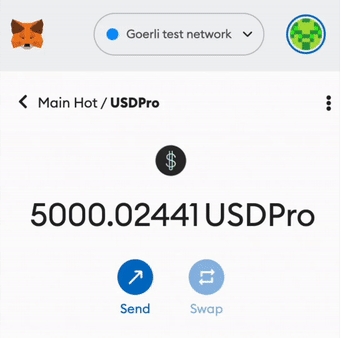

USD Pro – a $1‑pegged, yield‑bearing stablecoin that auto‑grows in your wallet from three on‑chain revenue streams;

StableUnit lending – allows to borrow stablecoins against LPs, yield‑optimizers positions without giving up your farming rewards.

Overview

USD Pro is the first fully DeFi‑compatible, yield‑bearing stablecoin that never rebases or drifts above its peg. Built on the battle‑tested MakerDAO core, it trades 1:1 with USDC or USDT anywhere, but quietly compounds yield sitting in your wallet—no staking, no claims, zero clicks. Need to offramp? Swap it for USDC/USDT instantly.

StableUnit lending — a permissionless market letting you borrow stables using productive collateral—plain ETH/WBTC, Uniswap V3 or Balancer LP tokens, Pendle/Aura receipts, and soon cross‑chain bridge liquidity. Your collateral keeps earning; the protocol never touches your yield. You can leverage, loop, or just borrow paying an ultra‑competitive borrow rate.

Analogy

While your collateral keeps farming, think of USD Pro as a high-yield savings account in your pocket. Just by holding it, your balance grows every block and outperforms typical RWA‑stablecoins.

Quick Start

Basics on How does it work page

See the difference on Why StableUnit page

See Getting Started for a step-by-step guide on acquiring USD Pro on supported exchanges (e.g. Uniswap) or borrow in the StableUnit dApp and earning passive yield.

See Governance & Tokenomics to participate in StableUnit DAO and contribute to governance, propose upgrades, or build on our open-source smart contracts.

See Architecture section to learn more on how to build on StableUnit. DeFi builders can integrate USD Pro into lending, trading, or payments just as they would any ERC-20 token.

Demo

Latest Announcement

The project is in the alpha/beta testing stage. Please contact us for access.

Last updated